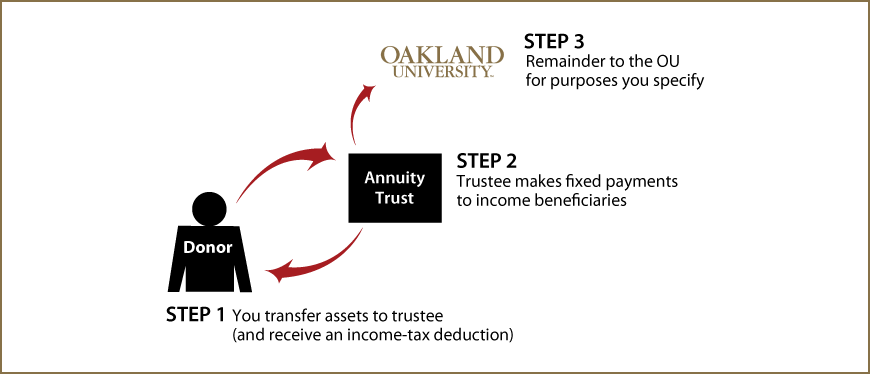

Charitable Remainder Annuity Trust

How It Works

- Create trust agreement stating terms of the trust; transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes payments to income beneficiaries you designate

- Remainder to OU for purposes you specify

Benefits

- Payments to one or more beneficiaries that remain fixed for the life of the trust

- Federal income-tax deduction for the charitable remainder value of your interest

- No capital-gain tax when trust property is sold

- Trust remainder will provide generous support for OU

Request an eBrochure

Request Calculation

Contact Us

Colette O'Connor

Sr. Director of Planned Giving

(248) 370-3698

oconnor@oakland.edu

Oakland University

Office of Planned Giving

John Dodge House

507 Golf View Lane

Rochester, MI 48309

Federal Tax ID Number: 38-1714400

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

University Advancement

Office of Planned Giving

John Dodge House

507 Golf View

Rochester, MI 48309-4488

(248) 370-3698

Fax (248) 370-6141

giftplan@oakland.edu